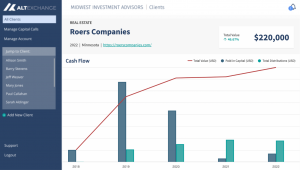

Roers Companies clients can now access automated reporting for all real estate investments, powered by AltExchange.

NEW YORK CITY, NEW YORK, UNITED STATES, December 15, 2022 /EINPresswire.com/ -- Today, AltExchange and Roers Companies announce a partnership to modernize and digitize real estate investment reporting for Roers Companies RIA partners. This strategic partnership solves many of

the challenges RIAs face today: The ability to provide private investment access to top clients, monitor and aggregate clients’ entire portfolio of alts, and differentiate themselves within the alternative investment space through transparency and an unmatched investor experience.Through AltExchange platforms, Roers Companies investors and advisors now have access to:

- Real-time reporting and consolidation of Roers Companies real estate investments.

- Historical reporting on existing Roers Companies investments.

- Automatic collection of investment tax documents (K1s, 1099s).

- Fully-managed capital calls (automated reminders & notifications).

- Integrations for RIAs with existing wealth management systems.

Jeffrey Grant, Senior Managing Director at Roers Companies said:

“At Roers Companies, we are excited to partner with AltExchange on their ground-breaking reporting technology. Providing access to private investments is one thing, but the ability to track, value, and consolidate them for our clients is next-level. We believe this will elevate the RIA’s value proposition in alternatives while providing an amazing client experience.”

Zak Boca, CEO of AltExchange said:

“AltExchange is excited to partner with the team at Roers Companies to provide an easier way for RIAs to manage the back-office work associated with alternative investments. When asset managers seek distribution through RIAs, a top objection they receive is that the back-office workload is too complex to manage. We’re thrilled to be solving that objective with our platform.”

For more information on Roers Companies investment opportunities, please contact Jeffrey Grant at jeffrey.grant@roerscompanies.com. For media inquiries, please contact Heather Ouellette at media@roerscompanies.com.

To begin automating alternative investments for your clients or yourself, please reach out at hello@altexchange.com.

No comments:

Post a Comment